How to Start Margin Trading

How to Start Trading Perpetual Futures

How to Start Margin Trading

In order to start margin trading, you need to complete these 3 easy steps:

- Make sure you have 2-factor authentication enabled.

- Add assets to the Margin Account.

- Make your first trade.

Adding assets to the Margin Account

Note that the assets used for collateral will be reserved on your balance and won’t be available for trading.

1. Make sure you have assets on the Spot Account, then press "Margin."

2. Press the green "Margin" button on the top right.

3. A pop-up will appear. Enter the desired amount of collateral (margin) and press the "Transfer" button.

4. Now your Buying Power has multiplied by 10. In this example, 500 USDT was borrowed, with collateral of 50 USDT.

5. Note that you can add more funds to your collateral (margin) at any time.

Margin Market Trading

Placing a margin order is similar to placing an order on the spot markets. The Buying Power is the total amount of assets that can be used to open a position. Note that before the first margin order is filled, your margin position is zero and can be canceled at any time without incurring any charges.

When trading on margin, the order types are exactly the same as those of spot markets. The following links can help you learn more about market orders, limit orders, and scaled orders.

How to change the amount of collateral?

You can retrieve funds from your margin at any time.

1. To retrieve margin, press “Margin” at the top right corner.

2. Click the green "Margin" button, enter the desired amount, and press "Transfer." The funds will become available on your Spot Account.

3. Note that if you have an open position, you can retrieve only part of the margin. The system won’t allow you to transfer the Required Margin, which is needed to maintain your current position open.

Learn more about Margin Trading here.

How to Start Trading Perpetual Futures

In order to start trading perpetual futures, you need to complete these 4 easy steps:

- Make sure you have 2-factor authentication enabled.

- Add assets to your Derivatives Account.

- Add margin.

- Make your first trade.

Adding assets to the Derivatives Account

Note that the assets used for collateral will be reserved on your balance and won’t be available for spot trading.

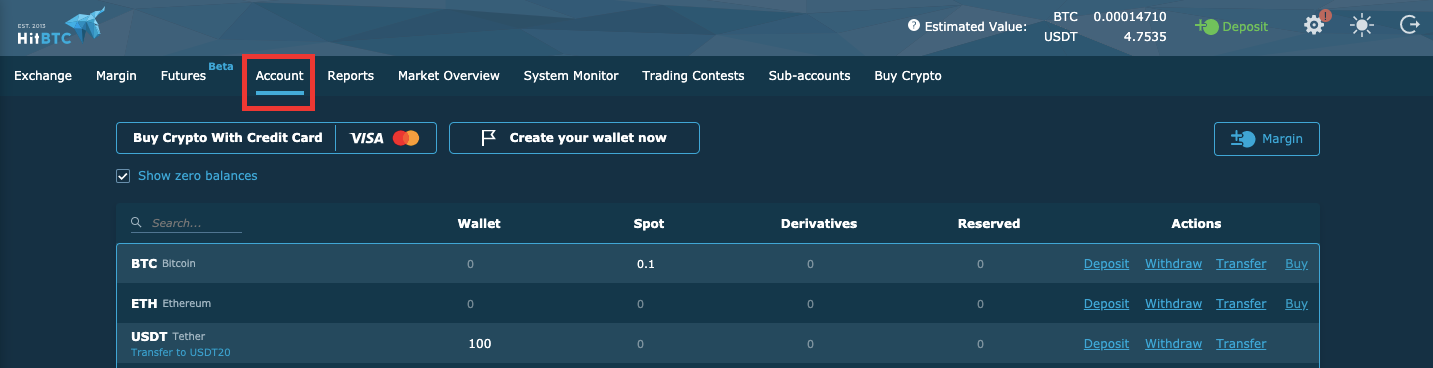

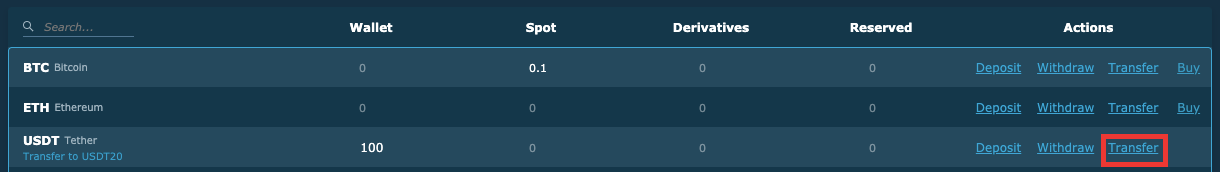

2. Press the "Transfer" button on the right.

3. A pop-up will appear. Choose an Account you want to transfer from (Spot or Wallet) and choose the Derivatives Account in the "to" drop-down menu. Enter the desired amount of collateral (margin) and press the "Transfer" button.

Adding Margin

1. Go to the Futures tab.

All available contracts are visible in the Contracts widget.

2. You will need to add the margin, which will act as the collateral for this contract.

For example, you need a BTC/USDT contract. Click the Margin button on the top:

Fill in the fields on the "Add margin" tab and press the "Transfer" button.

- Amount – the currency amount, that will be used as collateral.

- Leverage (x1-x100) – the ratio of the trader's funds to the funds required to open a position. Leverage is provided by our platform and allows the trader to perform trades, the volume of which significantly exceeds the size of the client's own funds.

Futures Market Trading

1. Go to the Futures tab.

All available contracts are visible in the Contracts widget.

Select the following data:

- Amount – the desired currency amount to sell or buy.

- Price – the price for the trade (if you're about to place a limit order).

- %% indicator – allows setting the position volume as a percentage of Buying Power.

- Total – the desired currency amount to receive or spend in the trade.

The following data is calculated by the system:

- Position – the desired currency amount to sell or buy (from the Amount field).

- Buying power – the currency amount available for spending.

- In orders – the currency amount reserved for the current orders.

- Best bid/ask – the best price for this side in the Market Depth.

- Liq. Price – liquidation price. When the currency pair price on the market reaches this value, the contract will be automatically liquidated (see the Liquidation article).

- If the futures contract price will be lower than Liq. Price, the part of the margin collateral will be used to cover losses.

When trading perpetual futures, the order types are the same as those of spot markets. The following links can help you learn more about market orders, limit orders, and scaled orders.

3. The newly created contract will be visible in the My orders and trades widget.

The contract has the following fields:

- Contracts – the main data (currency pair, leverage, Long/Short).

- Position Size – the contract size in a currency that you wish to buy or sell.

- Entry price – the relevant currency pair volume-weighted average price in the futures market at the time of the contract's creation.

- Price – liquidation price. When the currency pair price on the market reaches this value, the contract will be automatically liquidated (see the Liquidation article). If the futures contract price turns out to be lower than the Liq. Price, the part of the margin collateral will be used to cover the losses.

- Risk – an index that shows how close the position is to liquidation. The greater the selected leverage, the less price movement would need to happen in an unfavorable direction for the liquidation to occur.

- Unr. PnL (Unrealized Profit and Loss) – a profit or loss that you will incur if the contract will be closed by the current mark price. You may click the Close button to close it immediately.

- PnL (Profit and Loss) – a real profit or loss by this contract when the contract was partially executed.

PnL = (Trade Price – Entry Price) * Quantity.

ADL (Auto-Deleveraging) – a feature that covers the losses of some traders by the profits of others.

When a significant price movement occurs, some traders may not have enough margin collateral to cover their losses. This is when the ADL mechanism starts.

The indicator (from 0 to 4) shows how likely it is that the position will be used in the ADL procedure. So, if all indicator cells are active near the contract position, and there is a market situation when the liquidation loss cannot be covered, this contract will be automatically used to cover the losses of the opposite side.

Margin – margin collateral for this position.

Learn more about trading Perpetual Futures here .